The unprecedented sale in March 2021 of Everyday: The First 5000 Days, a digital collage by American digital artist Mike Winkelmann (Beeple) at a Christie’s auction, for $69.4 million, stunned the world and rattled the fine art industry.

The sale, the sum, and the item involved – the first time a non-fungible token (NFT) art piece was sold in a major auction house – made it a game-changer that has revolutionized and expanded the conversation around NFTs. All indicators show it’s the Big-Bang moment for NFTs! NFT art has sprung up alongside traditional art as a new genre captures imaginations and audiences. According to “The Art Market 2022” report, speculators and collectors spent $4.6 million in 2019 and $11.1 billion in 2021 on memes, GIFs, and an array of digital-based artwork, with the current value of NFTs being $65.1 billion.

There’s no doubt that NFTs have introduced an entirely new concept for how transactions can take place in the fine art industry that was largely unregulated, given the amount of money that flowed through it.

With NFT projects like Bored Ape Yacht Club by Yuga Labs enjoying a cult-like following due to its access to real-life and virtual events and the Metaverse, what does this mean for the traditional fine art industry?

Bridging Fine Art World and the NFT Ecosystem

It used to be almost impossible for fans, lovers, and collectors of art to access and buy fine art unless you belonged to the ultra-wealthy class. Similarly, young and upcoming artists’ desire to showcase their potential was heavily restricted by subjective artistic rules set up by galleries and art museums. And since most artists were not really in control, highly talented fine artists were starving amidst plenty.

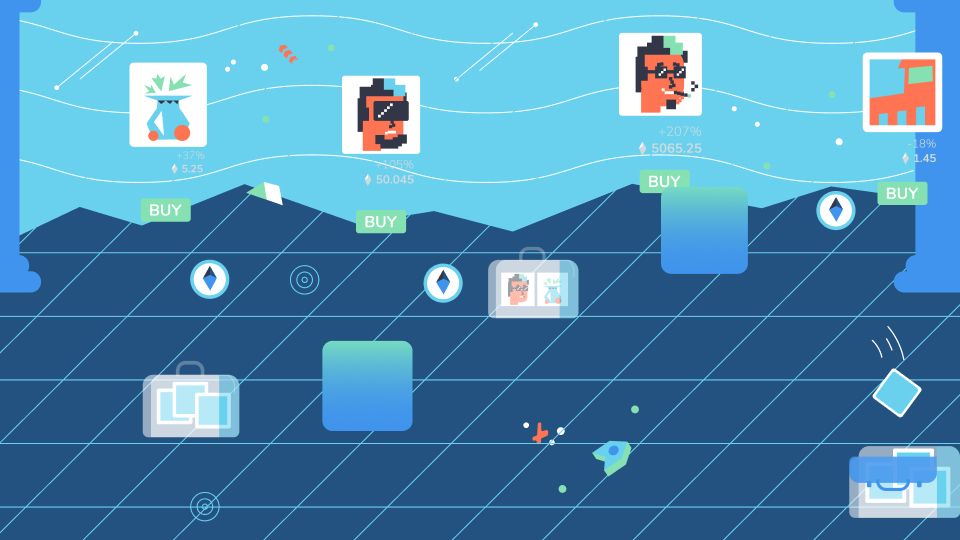

Enter the COVID-19 pandemic when all brick-and-mortar galleries shut down, and the NFT mania sprung up and took off. Suddenly, art lovers could freely access wide selections of artwork at every price range from everywhere in the world. Acquiring, selling, or transferring art pieces – albeit digitally – became as easy as buying anything from eBay without fear of purchasing a fake product. NFTs offer fine artists a chance to make an income.

An NFT is a digital tag attached to digitalized art, and like a security tag attached to an expensive product, it’s the certificate of originality that carries ownership history. Where a security tag inhibits a shoplifter from walking away with a product out of the store, NFTs publicly verify actual ownership over art pieces through the blockchain.

What do NFTs Bring to the Artists’ Table?

While NFTs have been an exciting invention for speculators and creators, they also offer some promising benefits for fine artists. Other digital creators in the writing, movies, music and gaming industries enjoy these benefits, which fine artists can now accrue via NFTs.

These benefits are:

Lowers Barriers to Entry

The introduction of the digital medium has dealt a deadly body blow to gatekeepers of the analog art world, thereby opening up access to more artists. There’s no longer a need for the enormous first-time investment needed before anyone could belong. Just like the proliferation of eBooks and self-publishing opened a world of opportunities to authors, NFTs have enabled artists to sell their work at a scale that creators and artists could never have dreamed of before.

Consider the success of projects like Bored Ape Yacht Club, CryptoPunks, MoonCats, and many more of these kinds you find in a marketplace like OpenSea.

Access to a Global Market

Trade online eliminates regulatory issues from different jurisdictions, making it easy to reach a global market. Few artists had the means and information to access the biggest galleries, exhibitions, or conventions where artists and collectors met regularly. NFTs have leveled the playing field and made art pieces accessible to everyone regardless of geographical location.

Physical pieces would only be available to the local community. Even when it was possible to trade traditional art pieces and collectibles online, the prospect of shipping an art piece worth millions across continents was frightening to both creator and collector.

Automatic Royalties

Artists who were lucky to sell traditionally enjoyed payday on the day they sold a piece and nothing more if their piece sold on the secondary market. This meant missing out on the real deal when their creation gained value with age. That left the artist with a fraction of the pay as collectors and speculators smiled all the way to the bank.

NFTs make it possible for artists to program royalties directly into a smart contract to automatically get a percentage of their work every time their creation changes ownership. Every subsequent sale will translate into money in an artist’s pocket until eternity.

Changes for Auction Houses and Art Dealers

Stories like Beeple’s or the Bored Ape Yacht Club may make some in the fine art community believe NFTs aren’t relevant to the work they deal in. However, auction houses, galleries and art dealers need to understand the potential NFTs have to completely disrupt their industry.

Those who move now to integrate and adjust their current business models will see the most benefit.

To increase their chances of success, fine artists interested in joining the NFT craze must:

- Understand NFTs: Learn about NFTs in the context of art and the relationship between the artist, the NFT platform, and the buyer to understand who owns what.

- Carefully choose an NFT marketplace: With over 50 NFT marketplaces for minting and trading NFTs, it’s easy to get lost since marketplaces aren’t created equal. Choosing a marketplace is similar to selecting an art dealer in a traditional art marketplace.

- Be smart about copyright: Artists must learn how and when to utilize the copyright act to protect their original works, seeing that copyright is the bedrock of intellectual property.

- Make Intelligent Business Decisions: With competition being so high and millions of dollars at stake, carefully plan how to shift your work to the crypto sphere. Take the time to understand the jargon, pick the right platform, and find expert knowledge about blockchain and NFTs.

NFTs have introduced a major disruption to the traditional art market. Getting it right in the burgeoning NFT space requires careful consideration of the practical, legal, and business aspects of this new way of doing fine art business. Like all other businesses, making slow and steady moves is the way for anyone dealing in fine art to approach the NFT market.