The first thing that comes to most people’s minds at the mention of Web3 is the news of Bitcoin hitting record highs (and lows) and stories of NFTs selling for hundreds of thousands of dollars. The main perception of Web3 is that it is meant for speculators trying to turn a profit from crypto, NFTs and other digital assets.

This misconception is understandable as DeFi and crypto investors have driven the majority of growth in the Web3 space in the past decade. However, Web3 has the potential for so much more. If the industry is going to grow and reach mass adoption, we need to move past this very limited view of what the technology is capable of.

Many misconceptions about Web3 and its true potential exist because perhaps its advocates haven’t done an excellent job educating the public about its benefits. Instead of being called the future of the internet, the phrases Web3, crypto investments, and NFTs investment are almost always used interchangeably or mentioned under the same breath.

This article will demystify Web3 and explain why there’s more to Web3 than the general rubric woven around the innovation about investing in crypto, NFTs, and DApps.

The Misleading Crypto Narrative in Web3

Growing polarities and raging global regulatory concerns have done little to deflect the world from the budding matter of cryptocurrency and its attendant technologies. As it groped to establish itself, the emerging crypto sphere continued to unleash a constant supply of technical jargon. From non-fungible tokens (NFTs), Decentralized Finance (DeFi), Decentralized Applications (DApps), and tokenomics – and then Web3.

As the rest of the world worried about getting a new investment frontier amid the disruption occasioned by the Covid-19 pandemic, blockchain and crypto enthusiasts stumbled upon a new development – Web3. Soon the new development got intertwined with DeFi and NFTs as the idea that there was more to cryptocurrencies than simply sending money and speculating around it as a form of investment. As a result, crypto enthusiasts hijacked the conversation, and crypto investments soon became synonymous with Web3.

Leading Misconceptions about Web3

While Web3 remains a world-changing opportunity to improve the current version of the internet, the nascent idea floated by crypto enthusiasts floating a mix of optimism and confusion has led to a few misconceptions including:

Misconception #1: Web3 is only for investors

The word “invest” is overused in Web3 and in most cases it’s used incorrectly. While there are Web3 elements that allow some form of investment, it’s never been the requirement for anyone to participate in Web3 technology. Some Web3 communities are just like clubs or associations that require membership handled through NFTs etc.

Misconception #2: You must own crypto or a token to join web3

Nothing is further from the truth, while there may be some “token-gated” Web3 communities; you could easily purchase the “token”, which could simply be an NFT via a digital wallet to participate.

Redrawing Web3 and Crypto Boundaries

Cryptocurrencies may have been around for at least a decade now. While numerous businesses accepted it as a form of payment, cryptos mostly endured as a form of speculative vehicle. However, crypto assets have recently undergone a long and painful downturn that has left a serious bloodbath among crypto startups. This saw a steady line of crypto brands extending their tentacles to invest in other areas of the Web3 ecosystem.

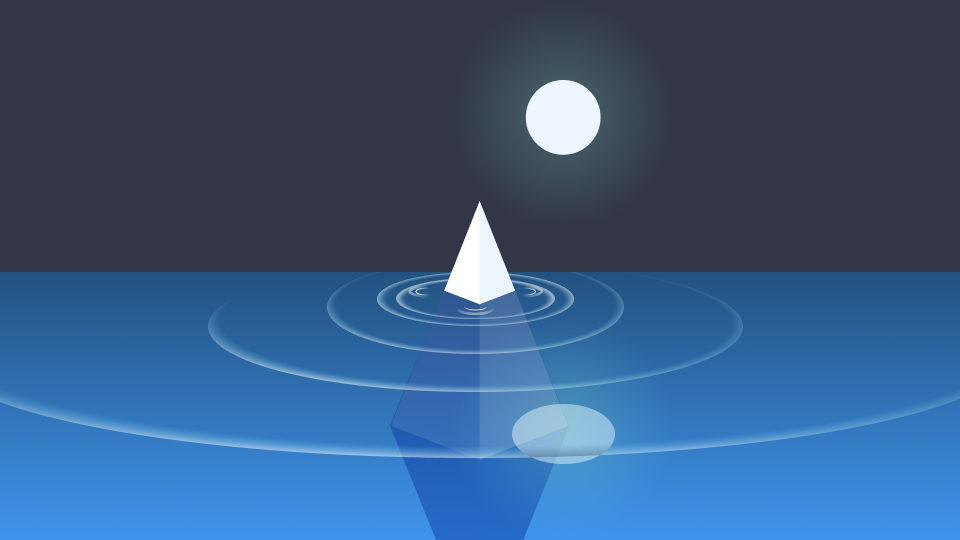

Web3 is a new breed of internet based on the blockchain that proposes to create an evolution that will move the virtual world from the Web2 infrastructure domiciled in centralized servers to a setup built on more inclusive and less biased decentralized applications built on the blockchain. As blockchain technology gets into the thick of the internet, it will likely transform the crypto space and make it more impactful.

Nonetheless, cryptocurrency isn’t synonymous with Web3 – it’s only one of the use cases of Web3 that’s built on the blockchain system. Web3 encompasses other concepts like decentralized autonomous organizations (DAOs), NFTs, DApps, and social tokens. Crypto remains a speculative byproduct of Web3 and most crypto-based businesses, which have mostly been seen as the true face of Web3, built their systems on this shaky foundation. The speculative boom of cryptocurrencies was a big part of Web3. Still, it’s time people started seeing the utility of Web3 beyond crypto for its disruptive potential in real life.

When the Tail Wags the Dog

The mainstream media was, in recent months, awash with clickbait-y, scary headlines that didn’t waste a chance to conflate the many negative things that hit the DeFi market. Related protocols failed as a result of the ongoing ‘crypto winter'. Serious flops were witnessed involving leading firms like Celsius, Three Arrows Capital, and Galaxy that had taken investor money to leverage and invest in DeFi.

Interested parties who believed that use cases like cryptocurrencies and DeFi were the complete picture of Web3 had a field day rolling out its obituary. The cryptocurrency market is said to have lost over $2 trillion since the November 2021 peak when Bitcoin retailed at $69,000. While the breakdown of the crypto prices remains painful, the truth is that the declining values are likely an indication of a slowed-down market. Equating the low crypto prices to the death of Web3 is akin to allowing the “crypto price tail” to wag the “Web3 dog.”

Harnessing Web3’s Disruptive Potential

The financial services industry has been at the forefront of adopting this nascent digital technology. Its ups and downs in line with crypto asset prices have helped inform its potential usage in other sectors. Most Web3 applications are built in the Ethereum blockchain, where participants use its native coin Ether (ETH) to pay for gas fees. However, with time, the incentive the Ethereum foundation offered users for validating transactions via crypto mining soon became a speculative burden. This has since been corrected via the recent Ethereum merge that changed the consensus mechanism from proof-of-work to proof-of-stake.

Important areas that must be addressed for users to harness Web3’s disruptive potential include the following:

Assets

Currently, only a few cryptocurrencies and NFTs appear as use cases for Web3. However, developers could include more stablecoins, CBDCs, tokenized real estate, and bonds and commodities to facilitate the coexistence of traditional and tokenized versions of different assets. This may be easily achieved by introducing tokenization that introduces real-world assets to the Web3 environment.

Infrastructure

Since new assets will likely emerge in the Web3 ecosystem, developers must strive to create the core infrastructure to support them as they mature. The infrastructure can cover areas like custody, tokenization, and settlement, to name a few. Initial web3 startups can partner with financial institutions to help them innovate their existing products for mainstream adoption.

Services

As the technology matures and startups provide supportive infrastructure, new Web3 equivalents of existing services in many areas will emerge. This could include payment networks, media platforms, Web3-gaming, and the metaverse. Web3 disruptors must deliberately partner with incumbents or, better still, tap into their services to sell new value propositions to their user bases.

Web3 is still in its infancy, and issues surrounding regulation, value, and functionality must be addressed before it can reach mass adoption. As with all new disruptive technologies, Web3 must overcome its steep association with crypto investments to its real potential.